Why Interest Rates and Home Prices Move in Opposite Directions

Low interest rates make borrowing cheaper. Buyers can afford larger mortgages, which increases demand and pushes home prices higher. High interest rates make borrowing more expensive. Fewer buyers can qualify for large mortgages, so demand cools, and prices tend to stabilize or decline.

The 2021 Housing Spike: A Case Study

In 2020 and 2021, the Federal Reserve cut interest rates to near-zero to support the economy. Mortgage rates dropped below 3%, the lowest in history. Suddenly, buyers could stretch their budgets further, and sellers benefited from soaring demand. The median U.S. home price jumped from around $322,000 in 2019 to over $408,000 by mid-2021.

The Math: How a 1% Interest Rate Increase Impacts Payments

Imagine you buy a $400,000 home with 20% down ($80,000). Your loan amount is $320,000 on a 30-year fixed mortgage.

Case 1: 3% Interest Rate → Monthly Payment ≈ $1,349

Case 2: 4% Interest Rate → Monthly Payment ≈ $1,528

That’s an increase of $179 per month, or $64,440 more over the life of the loan.

Why This Matters for Buyers and Sellers

For buyers: Even a small interest rate increase can price you out of a home. At 3%, you might afford a $400,000 property, but at 7%, the same monthly budget might only cover a $300,000 home.

For sellers: High rates shrink the pool of qualified buyers. That often means slower sales and downward pressure on prices.

Key Takeaway

The 2021 housing market proved how powerful interest rates are in shaping affordability. As rates rise, buyers should budget carefully and run the numbers to see how payments change. Sellers, meanwhile, need to recognize that today’s buyers simply can’t pay yesterday’s prices when mortgage costs double.

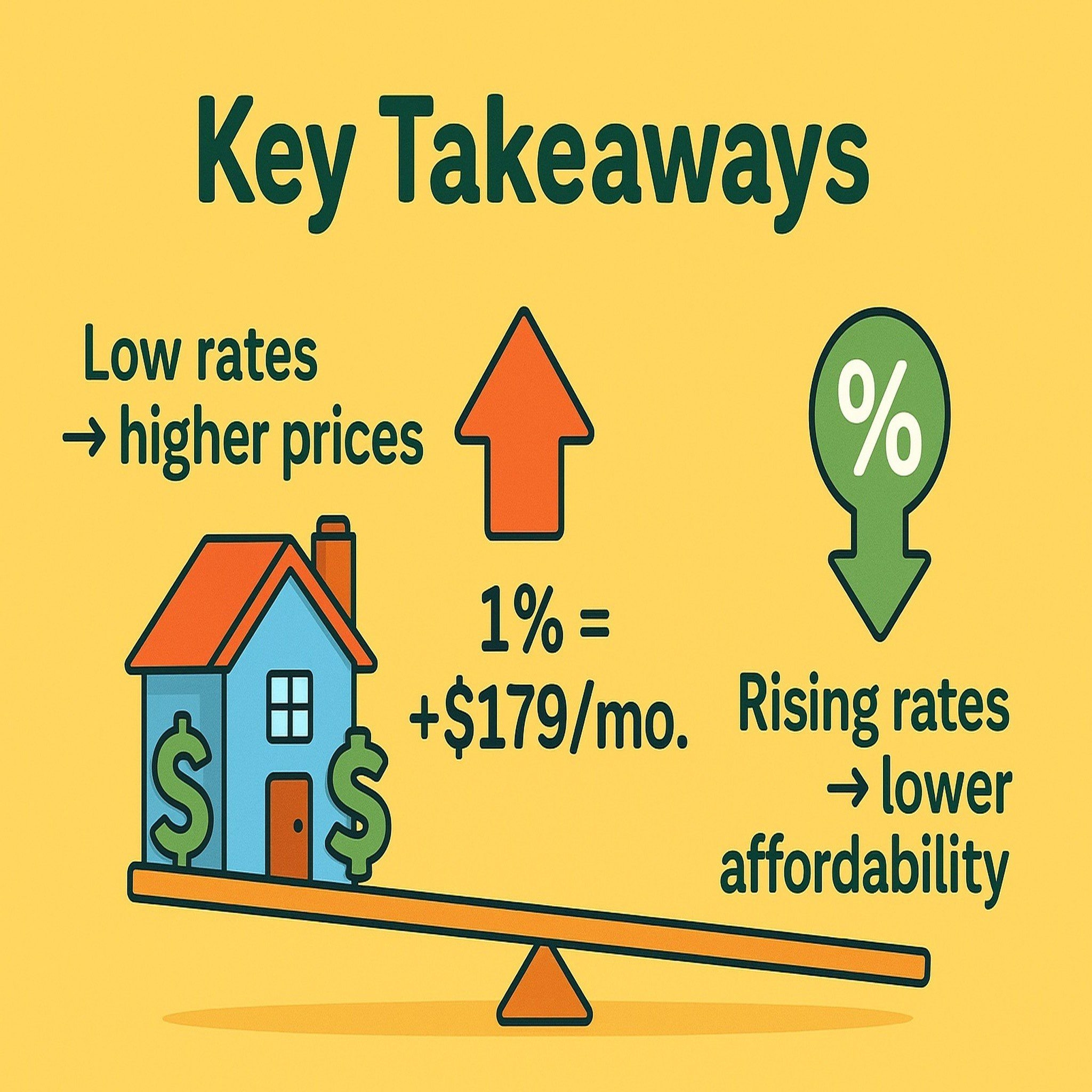

Infographic: Key Takeaways

- Low rates = higher home prices

- High rates = lower affordability

- 2021 spike: Prices soared with 3% mortgages

- +1% in rate = +$179/mo on $320k loan

- • Over 30 years = +$64,440