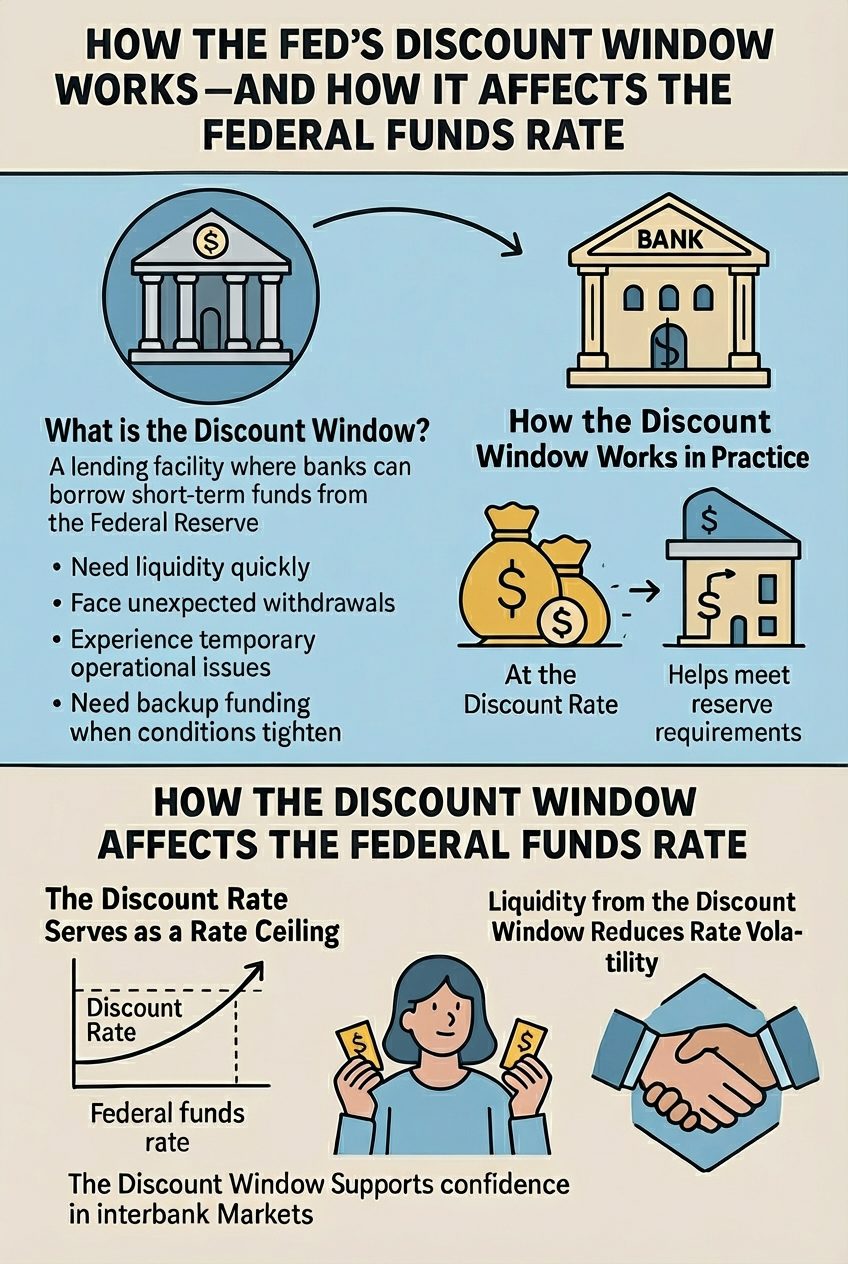

When people think about Federal Reserve policy, they usually picture interest-rate announcements and headlines about the federal funds rate. But behind the scenes, an equally important tool quietly shapes the financial system: the Discount Window. It’s one of the oldest and most misunderstood mechanisms the Fed uses to maintain stability, liquidity, and confidence in U.S. banking.

What Is the Discount Window?

The Discount Window is a lending facility where banks and credit unions can borrow short-term funds directly from the Federal Reserve. These loans are typically overnight but can be extended slightly longer depending on the situation.

Banks use the Discount Window when they:

– Need liquidity quickly

– Face unexpected withdrawals or cash shortages

– Experience temporary operational issues

– Want to avoid selling securities at a loss

– Need backup funding when market conditions tighten

How the Discount Window Works in Practice

Banks borrow funds and pledge collateral such as Treasury securities, mortgage-backed securities, or high-quality assets. The Fed provides cash at the Discount Rate, which is set above the current federal funds rate. Borrowed funds help banks meet their reserve requirements and smooth out liquidity issues.

How the Discount Window Affects the Federal Funds Rate

The federal funds rate is the interest rate banks charge one another for overnight lending of reserve balances. The Discount Window indirectly anchors this rate by acting as a ceiling on how high rates can rise.

- The Discount Rate as a Ceiling

If the federal funds rate climbs too high, banks can borrow from the Fed instead of other banks, pushing the rate back down.

- Liquidity Reduces Volatility

Discount Window borrowing increases the supply of reserves, applying downward pressure on the federal funds rate.

- Confidence Stabilizes Markets

Reliable access to liquidity boosts confidence in the banking system, stabilizing interbank lending rates.

Historical Examples

- 2008 Financial Crisis

Heavy Discount Window usage ensured liquidity and prevented the federal funds rate from spiraling higher.

- March 2020: COVID-19 Shock

The Fed slashed the Discount Rate and encouraged borrowing, restoring reserve market function.

- 2023 Bank Runs

Banks accessed the Discount Window to meet withdrawals, maintaining systemic stability.

The Discount Window affects:

– Mortgage rates

– Commercial real estate financing

– Investor sentiment

Stable bank liquidity keeps lending predictable and markets calm.

Final Thoughts

The Fed’s Discount Window is a foundational part of monetary policy. By stabilizing bank liquidity, it helps control the federal funds rate, maintain confidence, and prevent financial shocks from becoming crises.