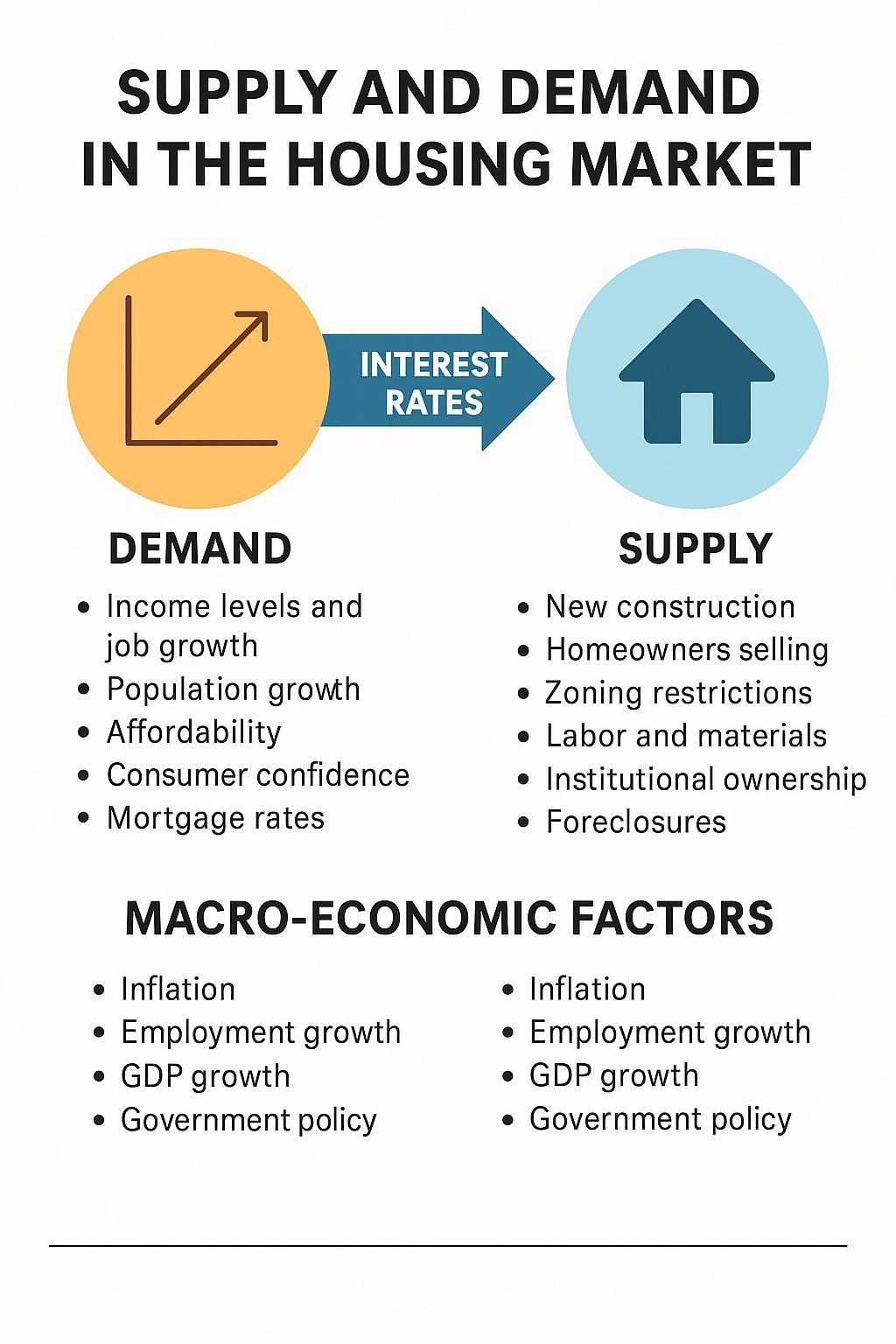

Understanding Housing Supply and Demand

The U.S. housing market is one of the most reliable reflections of broader economic activity. Shifts in interest rates, inflation, construction costs, and employment patterns all affect how buyers and sellers behave. Understanding how supply and demand interact is essential for navigating the market effectively.

What Drives Housing Demand?

Housing demand represents how many people want to purchase homes and how financially capable they are. Key demand factors include income levels, job growth, population expansion, affordability, consumer confidence, mortgage rates, and local market desirability. When demand exceeds available supply, prices typically accelerate.

What Influences Housing Supply?

Housing supply refers to the total number of homes available for sale. This includes newly built units and existing inventory. Supply is shaped by new construction volume, zoning regulations, labor and materials availability, institutional ownership, and homeowner willingness to sell. Long-term underbuilding continues to constrain supply in many regions across the U.S.

How Interest Rates Affect Housing Supply and Demand

Interest rates are one of the strongest forces impacting short-term housing market movements. Rising rates reduce affordability and dampen buyer demand, while also discouraging current homeowners from selling due to low existing mortgage rates. Conversely, falling rates expand affordability, attract investors, and encourage move-up buyers to list their homes.

The Role of New Construction

New construction serves as the long-term solution to housing shortages. Although construction adds supply, the process takes years due to permitting, regulatory hurdles, and labor constraints. New developments also attract buyer demand by creating new communities, improving infrastructure, and offering builder incentives such as rate buy-downs.

Macro-Economic Factors Influencing the Housing Market

Broader economic forces significantly impact the housing market. Inflation raises construction costs and triggers higher interest rates. Strong employment and wage growth support demand, while GDP expansion and positive consumer sentiment boost market confidence. Additionally, government policies, demographic shifts, and institutional investment all shape long-term housing trends.

Market Outlook

In the short term, a decline in interest rates could unleash pent-up demand and drive prices upward. However, inventory is likely to remain tight due to long-standing construction deficits. Over the next decade, persistent underbuilding, demographic trends, and migration patterns will continue influencing national and regional housing conditions.

Conclusion

The housing market is the result of a complex interplay between supply, demand, interest rates, construction activity, and macro-economic forces. Rising rates cool demand but also limit supply. New construction helps but lags behind population growth. Economic conditions such as inflation, employment, and consumer confidence remain key drivers. Understanding these variables allows buyers, sellers, and investors to make more informed decisions in any market environment.