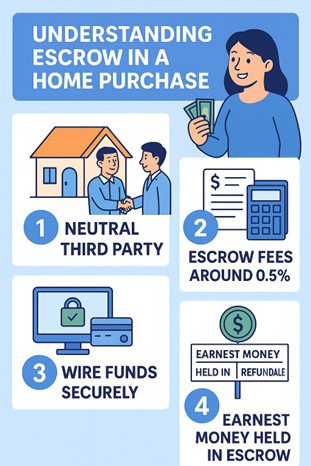

Buying your first home is exciting, but it comes with new terms and processes that can be confusing. One of those is escrow. This guide explains what escrow is, how it works, what it costs, safety tips for wiring funds, and how earnest money is handled.

WHAT IS ESCROW AND HOW DOES IT WORK?

Escrow is a neutral third-party service that protects both buyer and seller during a home sale. After an offer is accepted, the escrow agent holds funds and important documents until all conditions of the transaction are met. Neither party controls the money or property until everything is satisfied.

Escrow handles:

- Protecting funds (earnest money, down payment, closing funds)

- Document management (deed, loan docs, title transfer)

- Coordinating the closing process

TYPICAL ESCROW COSTS AND WHO PAYS

Escrow fees generally cost between 1%–2% of the purchase price and may be structured as flat fees or percentage-based. In many markets, the buyer and seller split the fee 50/50, but this can vary based on local customs and negotiation. All escrow fees will appear on your Loan Estimate and Closing Disclosure.

HOW TO SAFELY WIRE FUNDS INTO ESCROW

Wiring funds is common but must be done securely to avoid fraud.

Steps:

- Get wiring instructions from your verified escrow officer.

- Call the escrow company using a known phone number to confirm the details.

- Initiate the wire at your bank.

- Double-check account numbers and details before sending.

- Confirm receipt with the escrow company.

Safety Tips:

- Be suspicious of last-minute wiring changes.

- Never rely solely on email for wiring instructions.

- Always verify instructions over the phone.

EARNEST MONEY: REFUNDABLE VS. NON-REFUNDABLE

Earnest money is a good-faith deposit held in escrow. If the sale closes, it is applied to your down payment.

Earnest money is REFUNDABLE when:

- Inspection contingency fails

- Financing is denied under a financing contingency

- Appraisal comes in low with an appraisal contingency

- Any contingency is unmet within the contract timeline

Earnest money becomes NON-REFUNDABLE when:

- Buyer cancels for a reason not protected by a contingency

- Buyer breaches the contract

- Buyer waives contingencies and later finds issues

FINAL THOUGHTS

Escrow provides safety, structure, and fairness in your home purchase. Understanding how escrow works, how to safely wire funds, and how earnest money is handled empowers first-time buyers to navigate closing with confidence.