Selling your home can be an exciting milestone, but it often comes with a variety of hidden costs that many sellers don’t anticipate. From cleaning and staging to closing and commission fees, the total outlay can add up quickly. Understanding these expenses upfront helps sellers make informed decisions, set realistic price expectations, and maximize their net proceeds. Below, we’ll break down the key costs associated with selling a home and explain why each is necessary.

1. Preparing Your Home for Sale

Before your home even hits the market, presentation is key. Buyers are influenced by first impressions, so spending money on cleaning and cosmetic repairs can pay off.

– Deep Cleaning: Professional cleaning services can range from $200 to $600, depending on home size.

– Cosmetic Repairs: Fixing small issues (paint touch-ups, caulking, or minor hardware replacements) typically costs $500 to $2,000.

– Landscaping: Curb appeal matters. Expect $300 to $1,500 for trimming, planting, or lawn care.

– Staging: Professionally staging your home can cost $1,000 to $3,000, but staged homes often sell faster and for higher prices.

These costs are necessary to attract buyers, reduce negotiation friction, and potentially increase your final sale price.

2. The Impact of the Home Inspection

Once an offer is accepted, most buyers will request a professional home inspection. This process can reveal hidden issues that may lead to additional expenses or a lower sale price.

– Inspection Findings: If the inspector uncovers problems such as plumbing leaks, roof damage, or electrical issues, buyers often request repairs or price reductions.

– Repair Costs: Depending on the severity, repair expenses can range from a few hundred to several thousand dollars.

– Price Adjustments: If the seller chooses not to fix the issues, buyers may negotiate a lower offer to offset future repairs.

While a home inspection can feel like a setback, addressing issues proactively—or pricing accordingly—helps maintain buyer confidence and keeps the deal from falling through.

3. Realtor Commissions

Real estate agent commissions are often the largest single cost for sellers. Typically, the seller pays both their listing agent and the buyer’s agent.

– Typical Fee: 5% to 6% of the home’s sale price, split between agents.

– Example: On a $500,000 home sale, expect to pay around $25,000 to $30,000 in commission.

While this fee can feel steep, agents provide valuable services—marketing, negotiations, legal documentation, and ensuring the transaction closes smoothly.

4. Title and Escrow Fees

These fees cover the legal and administrative costs of transferring property ownership.

– Title Insurance: Protects against ownership disputes, typically $1,000 to $2,500 depending on home value.

– Escrow Fees: Charged by the title company or escrow agent for managing funds and documents, usually $500 to $2,000.

These fees ensure the sale is legally binding, funds are securely handled, and ownership transfers cleanly.

5. Transfer Taxes and Recording Fees

When property ownership changes, local governments charge taxes and fees.

– Transfer Taxes: Usually 0.1% to 2% of the sale price, depending on state and county laws.

– Recording Fees: Typically between $50 and $250.

These costs are unavoidable and go toward maintaining accurate public property records.

6. Seller Concessions and Home Warranty

To sweeten the deal for buyers, sellers sometimes offer incentives.

– Buyer Closing Costs Contribution: Sellers may contribute 1% to 3% of the sale price toward buyer’s costs.

– Home Warranty: Optional but appealing to buyers, costing $400 to $700 for one year of coverage.

These expenses can make your property more attractive in competitive markets.

7. Mortgage Payoff and Prepayment Penalties

If you still owe on your mortgage, part of your sale proceeds will go toward paying off the balance. In some cases, early payoff penalties may apply (though rare today).

– Mortgage Payoff: The remaining principal balance.

– Prepayment Penalty: 1% to 2% of the remaining loan balance if applicable.

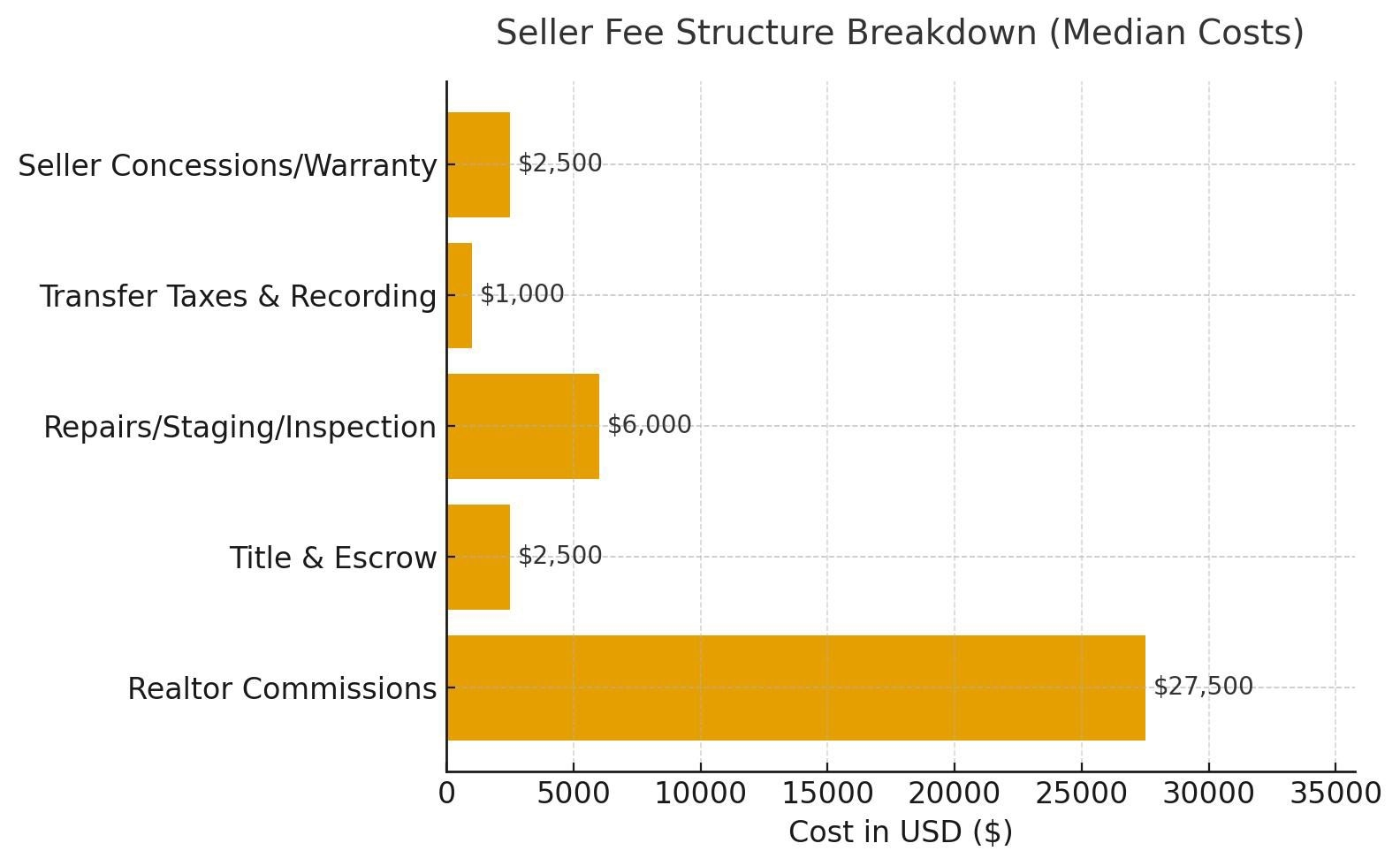

Median Seller Cost Breakdown (Typical $500,000 Home Sale)

| Expense Category | Typical Range | Median Estimate |

| Cleaning & Cosmetic Repairs | $700 – $2,500 | $1,500 |

| Landscaping & Staging | $1,300 – $4,500 | $2,500 |

| Home Inspection Repairs/Adjust. | $500 – $5,000 | $2,000 |

| Realtor Commissions (6%) | $25,000 – $30,000 | $27,500 |

| Title & Escrow Fees | $1,500 – $4,500 | $2,500 |

| Transfer & Recording Fees | $500 – $2,500 | $1,000 |

| Seller Concessions/Warranty | $1,000 – $5,000 | $2,500 |

| Total Estimated Cost | $32,000 – $52,500 | $39,500 (≈7.9%) |

Conclusion

While the cost of selling a home can feel overwhelming, each fee plays an important role in ensuring a smooth, legally sound, and marketable transaction. Cleaning and cosmetic work make your property shine; agent commissions ensure expert marketing and negotiation; inspection costs help avoid future surprises; and closing fees protect all parties legally and financially. By budgeting around 7% to 8% of your home’s sale price for these expenses, you’ll be better prepared for the true financial picture—and more likely to walk away with a successful sale.