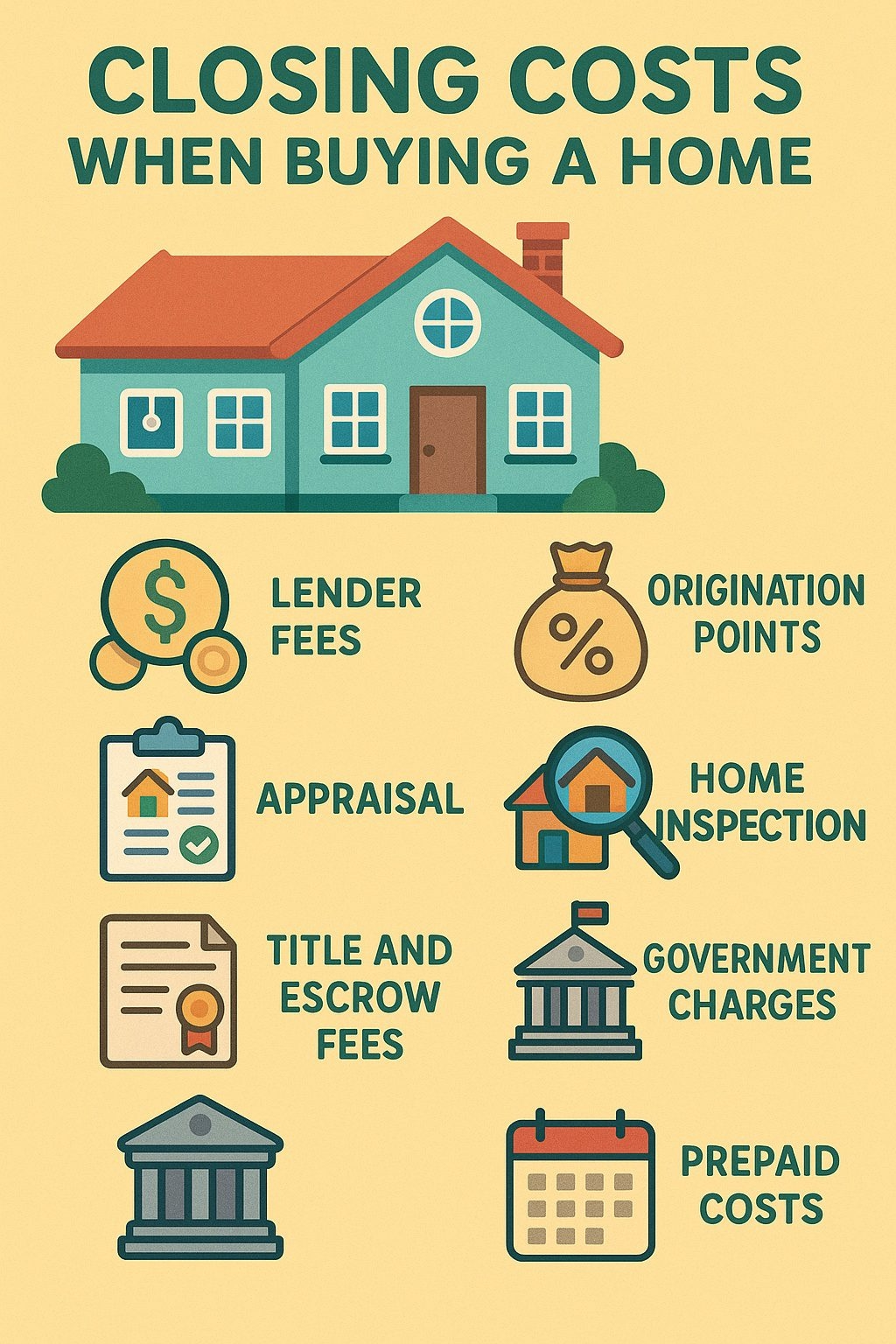

Buying a home is one of the most exciting milestones in life—but it can also be one of the most expensive. Beyond the down payment, homebuyers are often surprised by the number of fees that come with closing a home purchase. Understanding these costs ahead of time can help you budget better and avoid last-minute surprises.

1. Lender Fees

Origination Fee (0.5% – 1% of loan amount):

This is what your lender charges to process and prepare your loan. Sometimes it’s referred to as a loan origination point. For example, on a $400,000 loan, a 1% origination fee would cost $4,000.

Discount Points (Optional):

These are prepaid interest payments that can reduce your mortgage rate. Each point typically equals 1% of your loan amount.

Application Fee ($300 – $500):

Covers the cost of processing your mortgage application.

Credit Report Fee ($30 – $50):

Charged by the lender to check your credit history.

2. Appraisal and Inspection Fees

Appraisal Fee ($500 – $1,000):

Required by lenders to ensure the home is worth the amount being financed.

Home Inspection Fee ($300 – $600):

A professional home inspection checks the property’s structure, systems, and safety. It’s optional but strongly recommended.

Pest Inspection ($100 – $300):

Some lenders or states require this to ensure there are no termite or pest issues.

3. Title and Escrow Fees

Title Search ($200 – $400):

Ensures there are no legal claims or liens on the property.

Title Insurance ($500 – $1,000):

Protects both the buyer and lender from future title disputes.

Escrow Fee ($500 – $1,000):

Charged by the escrow company that manages the funds and documents during closing.

4. Government and Recording Fees

Recording Fee ($100 – $300):

Charged by the county to record your new property deed.

Transfer Taxes or Stamps (Varies by state):

Some states or cities charge a tax based on the home’s sale price.

5. Prepaid Costs and Ongoing Expenses

Property Taxes (2 – 6 months prepaid):

Lenders often require a few months of taxes upfront to fund your escrow account.

Homeowner’s Insurance (1 year prepaid):

You’ll typically pay for your first year’s premium at closing.

Private Mortgage Insurance (PMI):

If your down payment is less than 20%, PMI protects the lender in case you default. It’s usually 0.5% – 1% of the loan annually.

6. Other Possible Fees

Attorney Fees ($500 – $1,500):

Required in some states or by preference to review contracts.

HOA Transfer Fee ($200 – $500):

If the home is in a homeowners’ association, there may be administrative fees to transfer ownership.

Courier/Notary Fees ($50 – $150):

Covers document delivery and notarization services.

Average Total Buyer Closing Costs:

Most homebuyers pay 2% – 5% of the purchase price in total closing costs. For a $400,000 home, that means you should budget between $8,000 and $20,000 beyond your down payment.

Final Tips for Homebuyers:

– Ask for a Loan Estimate: Lenders are required to give you an itemized list of all expected fees.

– Shop Around: Title companies, insurance, and even inspections can vary in cost.

– Negotiate: Sometimes sellers will agree to cover part of your closing costs.

Conclusion: Be Prepared, Be Confident

Buying a home comes with more than just a mortgage payment—there’s a long list of supporting costs that make the process possible. By understanding each fee upfront, you’ll avoid unpleasant surprises and ensure a smoother closing experience. Budgeting for these expenses not only helps you make informed financial decisions but also gives you confidence as you move into your new home. Remember, knowledge is the key to smart homeownership.