“Fix and flip” real estate investing is the process of buying a property below market value, renovating it to increase its worth, and selling it for a profit. It sounds simple, but successful flippers know it requires strategic financing, budget discipline, and tax awareness.

Using Hard Money Loans for Fix and Flip Projects

Most real estate investors use hard money loans to fund their fix-and-flip deals. These are short-term, asset-based loans secured by the property itself. Unlike traditional bank financing, hard money lenders care more about the property’s after-repair value (ARV) than the borrower’s credit score.

Typical Hard Money Loan Terms:

– Loan-to-Value (LTV): 70%–80% of ARV

– Interest Rate: 9%–14% annually

– Loan Term: 6 to 18 months

– Points (Origination Fees): 2–5 points (1 point = 1% of the loan amount)

Example: If you borrow $300,000 at 12% interest with 3 points upfront, that’s:

– $9,000 in points

– $3,000/month in interest

If the project runs 6 months, total financing cost ≈ $27,000.

Estimating Renovation Costs and Managing Overruns

Renovation costs can range widely:

– Light rehab (cosmetic): $20–$35 / sq ft

– Moderate rehab (kitchens, bathrooms, flooring): $35–$60 / sq ft

– Full gut remodel: $60–$100 / sq ft+

Unexpected issues — mold, foundation cracks, outdated wiring — can quickly eat into profits. It’s wise to add a 10–20% contingency buffer for unforeseen costs.

Selling Costs: What It Takes to Exit Profitably

When the property is ready to sell, factor in:

– Real estate commissions: 5–6% of sale price

– Closing costs: 1–2%

– Holding costs: property taxes, insurance, and utilities during the project

– Staging and marketing: $1,000–$3,000

Example: If your renovated property sells for $500,000, selling expenses might total $35,000–$40,000.

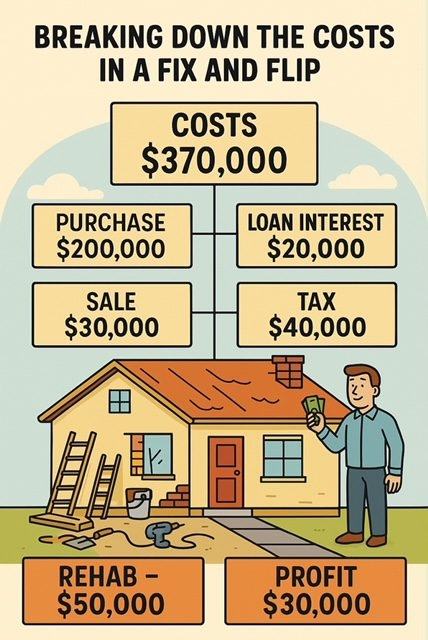

Average Profit Margins on Fix and Flips

According to recent housing data, average gross profits (sale price minus purchase and renovation cost) are around $65,000–$75,000 per property, but after financing, taxes, and overruns, the net profit often falls between $25,000 and $50,000. Returns vary greatly by market — higher in lower-cost regions with strong demand.

Tax Implications: Ordinary Income vs. Capital Gains

If you flip properties as a business — meaning you buy, renovate, and sell frequently — your profits are treated as ordinary income, not long-term capital gains.

That means:

– You pay taxes at your marginal income tax rate (which could be 22–37%)

– You owe self-employment tax if you operate as a sole proprietor

– You cannot defer gains using a 1031 exchange unless you hold the property as a true investment

To reduce taxes, many flippers form LLCs or S-Corps and keep good records of all deductible expenses, including interest, points, and materials.

Final Thoughts: How to Protect Your Profit

Fix-and-flip investing can be lucrative, but it’s also risky. The most successful investors:

– Use realistic budgets and conservative ARV estimates

– Work with reliable contractors and hard-money lenders

– Keep a tight construction schedule

– Understand that profit happens when you buy right, not just when you sell

With smart financing and careful management, you can turn distressed properties into profitable projects while avoiding common pitfalls.