Buying or selling a home is one of the biggest financial moves most people ever make. A key step in the process is the home inspection—a professional evaluation of the property that helps uncover potential issues before the sale is finalized. Whether you’re a buyer or a seller, understanding what an inspection covers, what it doesn’t, and the common problems that are often found can help you navigate the process more confidently.

What a Home Inspection Is

A home inspection is a thorough visual examination of a house, conducted by a licensed inspector, typically after an offer is accepted but before closing. The goal is to identify existing or potential problems with the property so buyers can make informed decisions, request repairs, or renegotiate terms.

The inspection generally takes 2–4 hours depending on the size of the home and results in a written report.

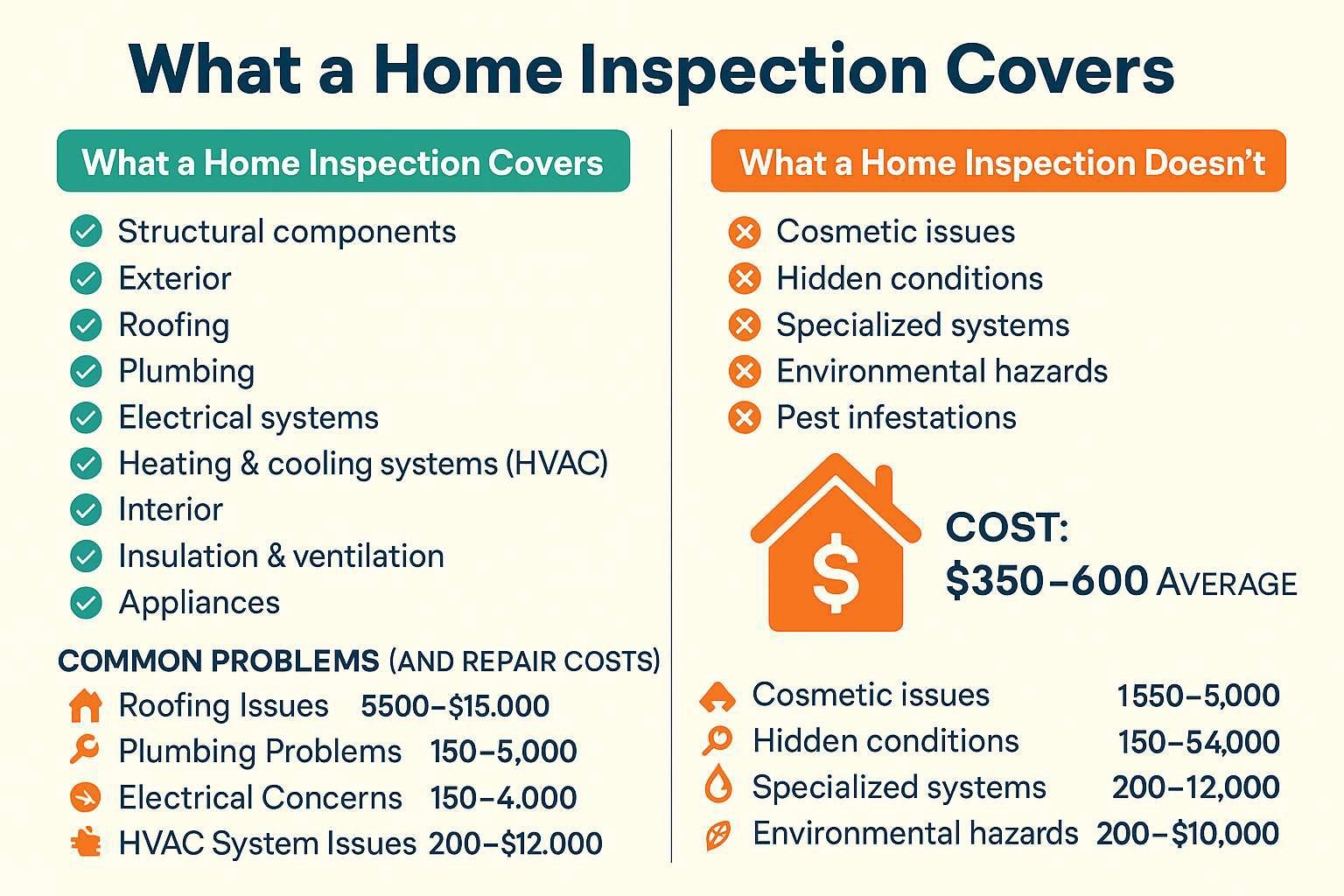

What a Home Inspection Covers

A standard home inspection usually includes:

- Structural components: foundation, basement, crawl spaces, framing, roof structure.

- Exterior: siding, windows, doors, gutters, decks, porches, grading/drainage.

- Roofing: shingles, flashing, chimneys, and drainage systems.

- Plumbing: visible pipes, fixtures, water heaters, water pressure, and drainage.

- Electrical systems: service panels, breakers, wiring, outlets, switches, and safety concerns.

- Heating & cooling systems (HVAC): furnaces, air conditioners, ducts, and vents.

- Interior: walls, ceilings, floors, stairs, railings, doors, and windows.

- Insulation & ventilation: attic, crawl space, and visible insulation.

- Appliances: built-in stoves, dishwashers, and other installed equipment.

What a Home Inspection Does NOT Cover

It’s important to remember that inspections are not exhaustive and typically do not include:

- Cosmetic issues (paint, flooring scratches, landscaping).

- Hidden conditions behind walls, under floors, or inside pipes.

- Specialized systems (septic, wells, pools, solar panels).

- Environmental hazards (mold, radon, asbestos, lead).

- Pest infestations (though inspectors may note evidence of pests).

For these, you often need specialized inspections or testing.

Common Problems Found in Home Inspections (and Rough Repair Costs)

Here are some of the most frequent issues inspectors uncover, along with rough cost ranges to fix them:

- Roofing Issues – Missing shingles, leaks, or aging roofs.

- Repair cost: $500–$2,000 for small repairs, $8,000–$15,000 for full replacement.

- Plumbing Problems – Leaky faucets, corroded pipes, or low water pressure.

- Repair cost: $150–$500 for minor fixes, $2,000–$5,000 for major pipe replacement.

- Electrical Concerns – Outdated panels, exposed wiring, or insufficient amperage.

- Repair cost: $150–$500 for small fixes, $1,500–$4,000 for full panel upgrades.

- HVAC System Issues – Old or poorly maintained furnaces and AC units.

- Repair cost: $200–$1,000 for repairs, $5,000–$12,000 for replacement.

- Foundation/Structural Cracks – Settling, moisture intrusion, or instability.

- Repair cost: $500–$3,000 for small cracks, $10,000–$30,000+ for major repairs.

- Water Damage or Drainage Issues – Poor grading, leaking basements, mold.

- Repair cost: $1,500–$5,000 for waterproofing, higher if extensive damage.

- Insulation & Ventilation Deficiencies – Drafty attics or poor energy efficiency.

- Repair cost: $1,500–$3,500 to add insulation.

How Much Does a Home Inspection Cost?

On average, a home inspection in the U.S. costs $350–$600, depending on the location, size, and age of the home. Larger or older homes may be more expensive to inspect. Optional add-ons (radon, termite, mold testing) can add $100–$300 each.

Why a Home Inspection Matters

For buyers, a home inspection provides peace of mind and can be a powerful negotiation tool. For sellers, addressing issues ahead of time can make the sale process smoother and prevent lastminute surprises.

In short: while an inspection is not a guarantee of a problem-free home, it’s one of the smartest investments you can make during the buying or selling process.